Institutional Investors Favor Ethereum ETFs

Analysts have noted a significant shift in the behavior of institutional investors. Previously, Bitcoin ETFs were the main attraction, but now Ethereum ETFs are seeing substantial inflows while Bitcoin ETFs are experiencing outflows.

Ethereum ETFs See Record Growth

The cryptocurrency market, especially Ethereum ETFs, is undergoing a major transformation. Despite a rocky start, Ethereum ETFs have shown exceptional growth. Analysts had predicted that Ethereum ETFs might outperform Bitcoin ETFs, and this prediction is now coming true.

Joint Inflows for Bitcoin and Ethereum ETFs

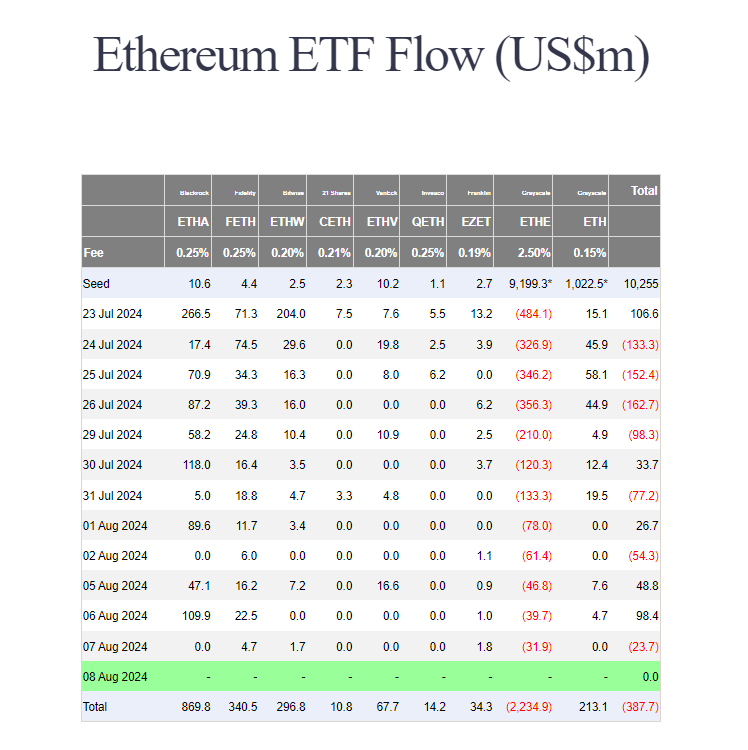

On August 1st, both Bitcoin and Ethereum ETFs saw inflows for the first time since the launch of Ethereum spot ETFs. Bitcoin ETFs attracted $50.6 million, led by Grayscale's new Bitcoin Mini Trust, while Ethereum ETFs gained $26.7 million, with BlackRock’s iShares Ethereum Trust leading the way.

Despite earlier struggles, Ethereum ETFs have managed to stay on course while Bitcoin ETFs have faced setbacks. This trend was highlighted by data from Farside.

Ethereum ETFs Surpass Bitcoin ETFs

BlackRock’s iShares Ethereum Trust (ETHA) has been at the forefront of the Ethereum ETF success story. Since its launch, this ETF has accumulated nearly $870 million in assets, solidifying its position as a leading cryptocurrency fund.

Ethereum ETFs have shown remarkable resilience. On August 5th, they continued to receive significant inflows, totaling $50 million, with an additional $109 million coming in the following day.

Data from Farside also shows that on August 6th, all Ethereum ETFs together recorded inflows of more than $98 million, with ETHA leading at $109 million. Fidelity’s FETH saw $22.5 million in new investments, while Grayscale’s ETHE had outflows of $39.7 million.

Bitcoin ETFs Face Significant Outflows

In contrast, Bitcoin ETFs have experienced substantial outflows. Data from Farside indicates that on August 6th, Bitcoin ETFs saw outflows totaling $148 million. BlackRock’s Bitcoin spot ETF, IBIT, recorded no inflows during this period. Instead, Fidelity’s Bitcoin spot ETF, FBTC, saw outflows of $64 million, and Grayscale’s GBTC also had outflows of $32 million.

Individual Investors Still Prefer Bitcoin

Despite the growing interest in Ethereum ETFs among institutional investors, Bitcoin remains the favorite for individual investors. While both cryptocurrencies have seen price drops, Bitcoin continues to outshine Ethereum in terms of price performance.