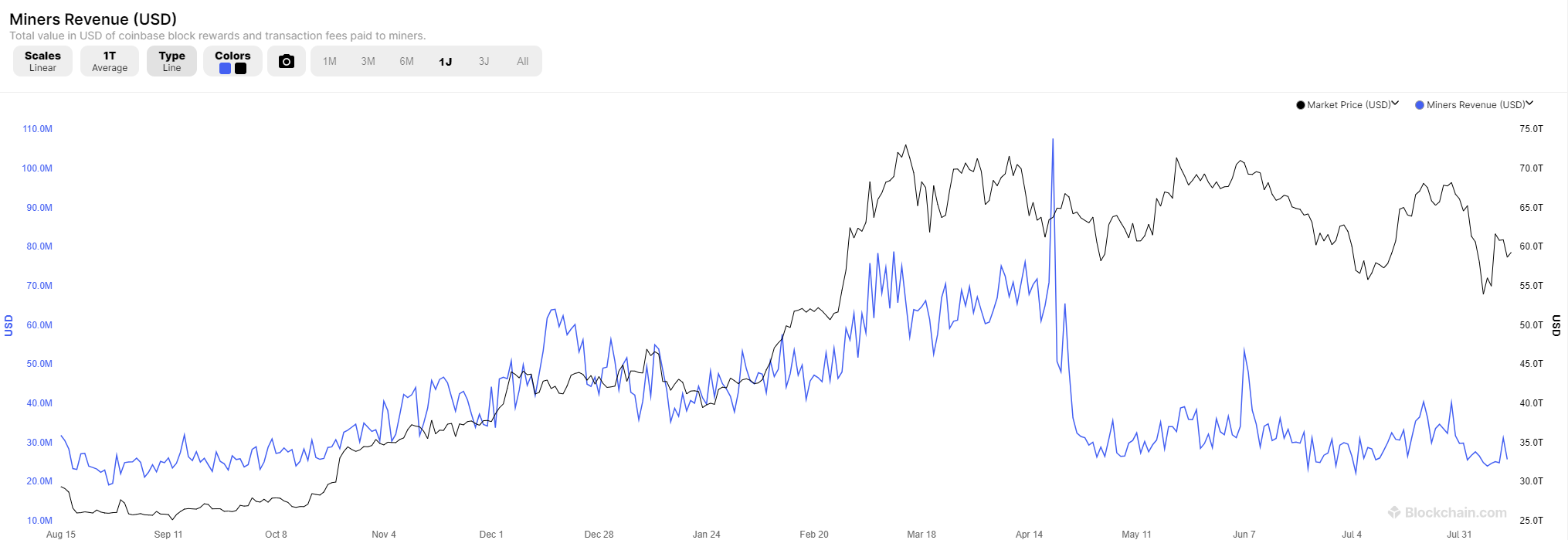

Over a two-week period, the revenue of Bitcoin miners, primarily generated through block rewards and transaction fees, steadily declined, reaching a new yearly low on August 11.

On August 11, the daily revenue of Bitcoin miners fell to a new yearly low of $2.54 million, marking the lowest point since October 2023. The Bitcoin mining community had long anticipated a significant revenue drop following the Bitcoin halving on April 20, which reduced mining rewards from 6.25 BTC to 3.125 BTC.

Source: Blockcahin.com

A New Bitcoin Mining Strategy is Needed

As expected, daily revenues from Bitcoin mining fell below $3 million for the first time in May. In contrast, the mining community had earned around $6 million per day during the first four months of 2024.

However, the rising Bitcoin price and the hype surrounding other protocols within the Bitcoin ecosystem were enough to sustain mining operations. Additionally, major Bitcoin mining companies like Bitfarms planned to overhaul their mining equipment to remain profitable amidst the uncertainties.

Following the significant drop in May, daily revenues for Bitcoin miners briefly increased before entering a two-week freefall to a new annual low. The main causes of the declining revenues include a prolonged bear market, a decreased Bitcoin price, increased network difficulty, and subsequent liquidations. Despite the sharp decline in daily revenues, shares of the Canadian Bitcoin miner Bitfarms rose nearly 22% after reporting better-than-expected second-quarter results. On August 8, Bitfarms CEO Ben Gagnon revealed how the company plans to remain profitable month by month. He stated:

"We continue to dramatically transform our operational profile through ongoing fleet upgrades and geographic expansion."

Bitfarms' total revenue of $42 million was 16% lower than in the first quarter and fell short of analysts' estimates. The miner attributed the decline to lower block rewards in its earnings report.