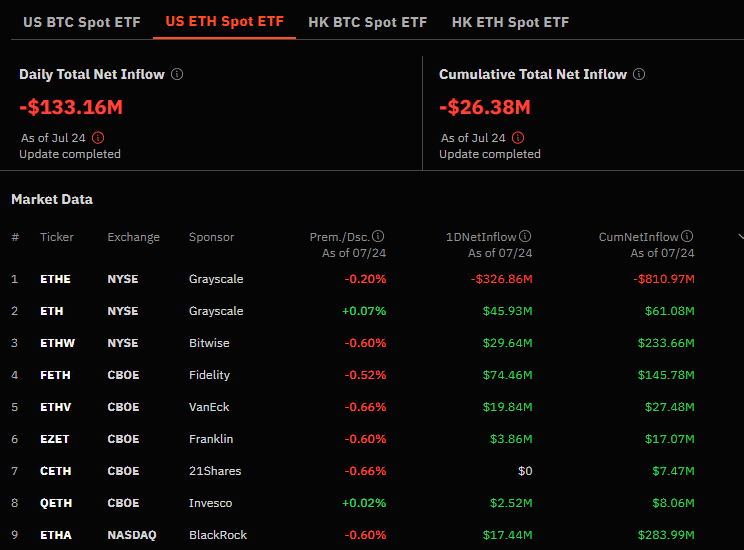

Data from Farside Investors reveals that spot Ethereum ETFs recorded a net outflow of $133.3 million on Wednesday, July 24. The Grayscale Ethereum Trust (ETHE) was particularly affected, seeing an outflow of $326.9 million.

In contrast, the first trading day for spot ETH ETFs saw over $1 billion in trading volume and net inflows amounting to $106.6 million.

Over the past two days, the ETHE fund has faced a total outflow of $811 million, according to Farside Investors. Meanwhile, the Grayscale Ethereum Mini Trust (ETH) recorded inflows of $45.9 million and $15.1 million on July 24 and 23, respectively.

The Fidelity Advantage Ether ETF (FETH) attracted the most inflows, totaling $74.5 million. Additionally, the WisdomTree Physical Ethereum Securities ETP (ETHW) and the VanEck Ethereum ETF (ETHV) reported inflows of $29.6 million and $19.8 million, respectively.

BlackRock’s iShares Ethereum Trust ETF (ETHA) saw $17.4 million in inflows on the second day, with total inflows reaching $266.5 million on July 23, according to Farside Investors. The Franklin Ethereum ETF Fund (EZET) and Invesco’s Ether Fund (QETH) contributed smaller net inflows of $3.9 million and $2.5 million, respectively. The 21Shares Core Ethereum ETF (CETH) remained neutral as the market shifted back into bearish territory.

Following these substantial net outflows from Ethereum ETFs, the price of Ethereum dropped by 7.6% over the past 24 hours, currently trading at $3,180. Ethereum’s market cap is approximately $382 billion, with a daily trading volume of $21.3 billion.

The broader crypto market is also experiencing bearish trends. CoinGecko reports that the global cryptocurrency market capitalization has declined by 3.4% over the past day, now standing at $2.43 trillion.