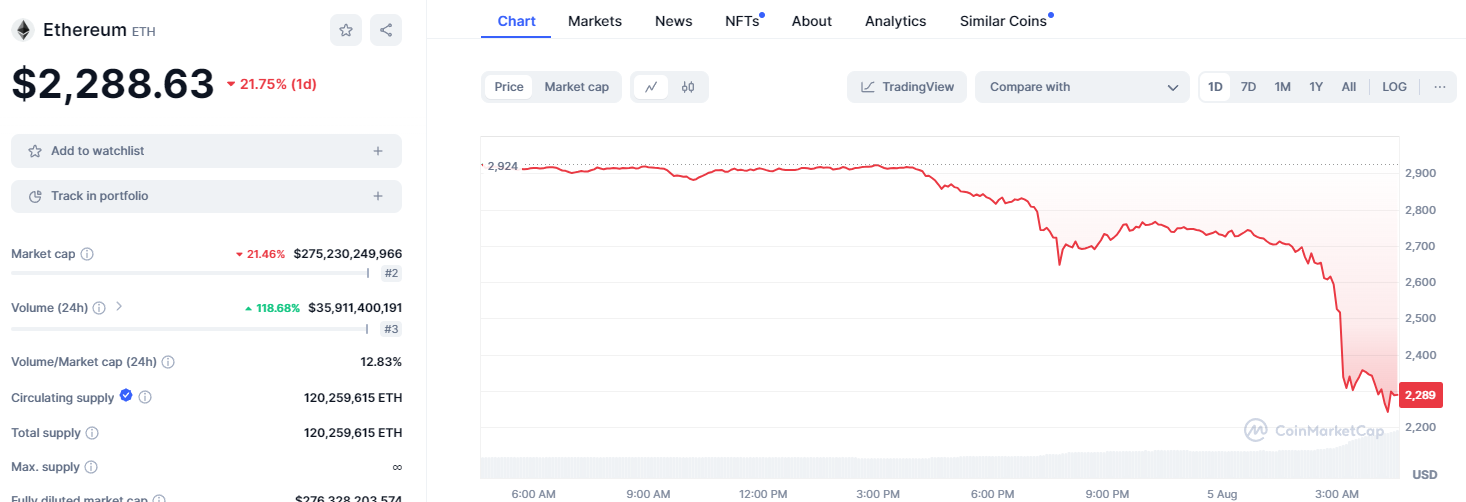

Although Bitcoin and Ethereum ETFs are likely to be included in model portfolios by the end of 2024, the current cryptocurrency market is experiencing significant declines. Bitcoin has dropped to $54,698, its lowest level since February, and Ether has fallen to $2,333.

This downturn is part of a broader cryptocurrency market sell-off driven by various factors, including weak wage numbers, significant asset movements by Jump Crypto, and increasing uncertainty surrounding the US presidential elections.

Impact of Jump Crypto and Presidential Elections

The extensive asset transfers by Jump Crypto, combined with speculation about potential liquidations due to a CFTC investigation, have heightened market volatility. Jung stated,

"Jump Trading transferred ETH to a central exchange amid rumors that the company might be forced to exit the crypto business due to a CFTC investigation."

Additionally, the growing support for Kamala Harris in the presidential race is contributing to investor uncertainty. Jeff Dorman, CIO of Arca, recently tweeted that increasing support for Harris could be negative for cryptocurrencies, as the market tends to favor Trump. Dorman remarked, "Even if the Democrats are less hostile toward cryptocurrency, the entire stock and crypto market is positioned for a Trump victory."

Furthermore, Justin d’Anethan of Keyrock pointed out that "this market feels ETH-led rather than BTC-led," indicating a shift in market dynamics. As investors navigate these turbulent conditions, they are also closely monitoring the potential impact of Jump Trading's situation and the possible effects of Mt. Gox withdrawals.