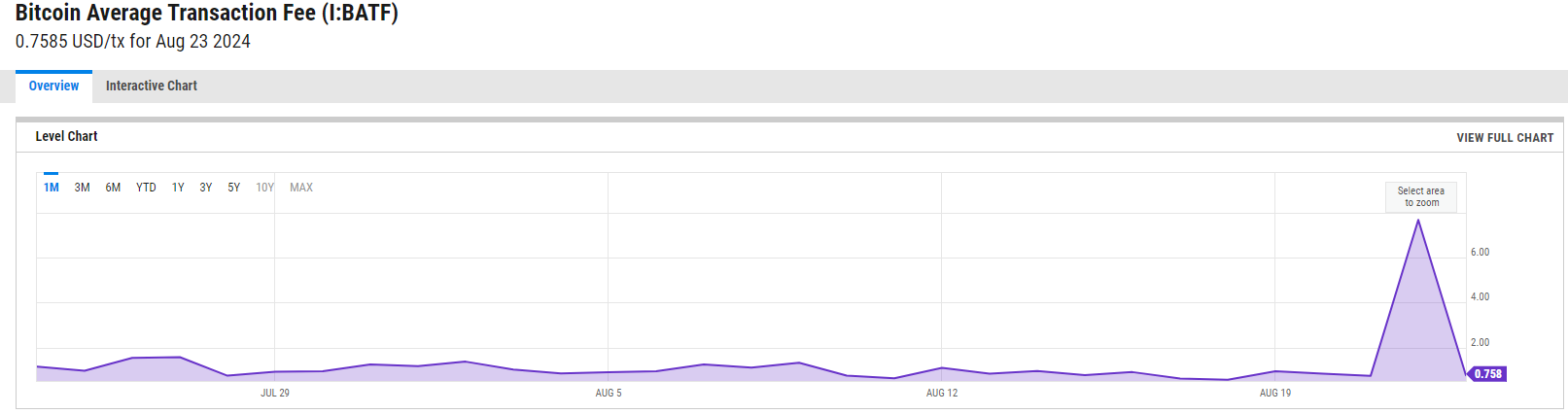

Average Transaction Fees for BTC Nearly Tenfold Increase

On August 22, the average transaction fee for Bitcoin saw a significant surge of 937.7%, jumping from $0.74 to $7.679 per transaction. This sharp increase is primarily attributed to heightened demand within the Bitcoin network.

Previously, transaction fees had remained relatively stable since July, mostly staying below the $1 mark. On August 18, fees even reached a historic low of $0.558. While low transaction costs make it easier for the general public to transfer Bitcoin, they can impact miners' revenues.

Looking at the trend of average Bitcoin transaction fees over a longer period, it becomes clear that the recent rise isn't the most significant in the past twelve months. For instance, from November 2023 to April 2024, there was an extended period when transaction fees fluctuated between $4 and $35 per transaction. This phase was followed by an even sharper spike in April 2024, when the average Bitcoin transaction fee reached an all-time high of $128.45 on April 20. The surge was mainly due to the Bitcoin halving event that occurred at the time. Notably, transaction fees remained well into double digits on average during the week before and after this event.

Source: ycharts.com

Another significant increase in fees occurred on June 7, 2024, when the average Bitcoin fee rose to $83.61. Since then, fees have steadily decreased, remaining below one dollar throughout August. The recent rise marks the first significant uptick since then, and it remains to be seen whether this value will quickly normalize or if we are at the beginning of a new phase of higher transaction fees due to increased network load and a higher volume of transactions.

To clarify, the Bitcoin network charges a fee for each BTC transfer to compensate miners for verifying transactions. The fee amount is directly tied to the demand for network resources—the higher the demand, the more expensive it becomes to send or receive BTC.

Current State of Bitcoin's Price Movement

With the rapid increase in transaction costs, a closer look at Bitcoin's price chart is particularly interesting. However, there has been no unusual movement today, as Bitcoin has gained little value over the last 24 hours. Currently, the price is up by just 0.3%, sitting at approximately $61,070. Compared to last week, there has been a more noticeable increase of 4.2%.

Looking at Bitcoin's price trend over the past month, there was initially a dramatic drop from highs around $70,000 to a low below $50,000 on August 5. This decline marked the most significant correction in the crypto market in a long time. Yet, this was quickly followed by an impulsive recovery, catapulting Bitcoin back above the $60,000 mark within a few days.

Since then, Bitcoin has been consolidating in a narrow range between $58,000 and $62,000. It is noteworthy that volatility has further decreased in recent days, suggesting that the price is stabilizing around $60,000. This consolidation could lead to a strong, impulsive price breakout in the coming days.

Currently, Bitcoin's market capitalization is $1.205 trillion, while the trading volume has slightly decreased to $25.75 billion over the past 24 hours. Bitcoin's dominance remains high at 55.7%, though it has declined by about 0.5% in recent days.

Source: coinmarketcap.com

If Bitcoin manages to break out upwards from the current consolidation phase and surpass the $62,500 mark, it could push the price towards higher levels of $65,000 and possibly back to $70,000. Establishing a sustainable position above the $70,000 resistance has been an outstanding target for several months. So far, it has repeatedly failed at this crucial level. A successful breakthrough, however, could quickly lead to a new all-time high and initiate another upward movement in the current bull market, potentially driving Bitcoin's price towards $100,000.