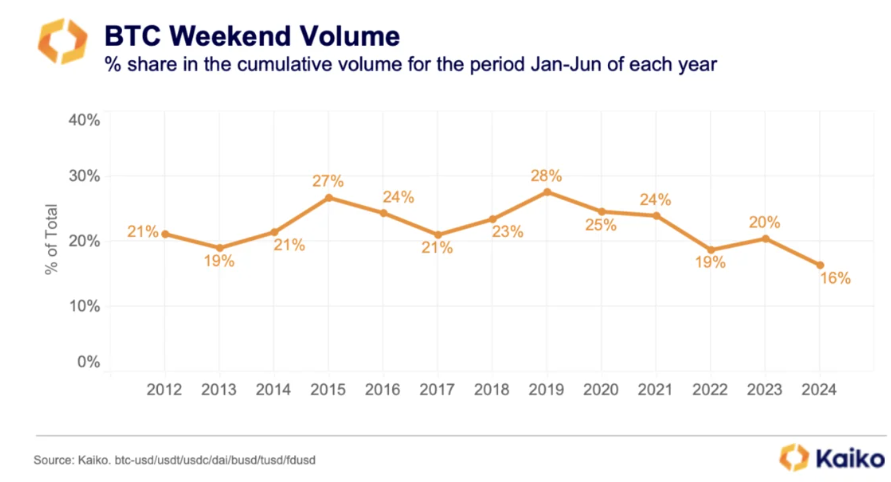

Bitcoin's trading volume this weekend is at an all-time low, down 16% compared to this time last year. Kaiko says that the introduction of spot Bitcoin ETFs has changed how BTC is traded. It's now more like traditional stock trading, and Bitcoin's price volatility has gone down. A quick look at the Bitcoin benchmarks shows that these benchmarks provide a daily index price for one BTC in USD, based on aggregated trading data from selected exchanges. The introduction of spot ETFs has made it easier to trade spot Bitcoin throughout the day.

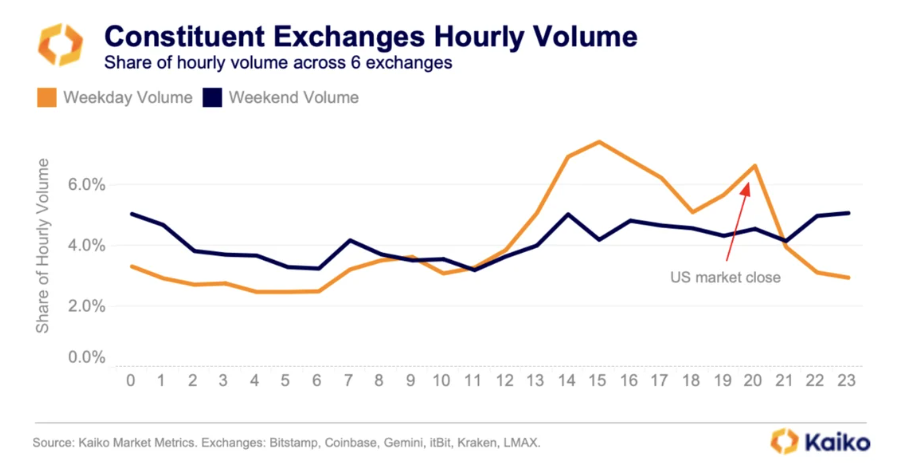

Now that liquidity providers and market makers are trading and hedging on the spot market, we're seeing higher spot trading volumes during the ETF benchmark fixing window. Spot ETFs work out their net asset value (NAV) using the fixed price for issuing and redeeming shares.

To get an accurate reference price, you need to buy and sell during the fixing window, which drives up spot volumes. The Bitcoin reference rates work out the index price using the trading data they get between 3:00 PM and 4:00 PM New York time. The main places you can trade this are Bitstamp, Coinbase, itBit, Kraken, Gemini, and LMAX Digital. Then each ETF works out its net asset value based on the reference index price after the market closes at 4:00 PM.

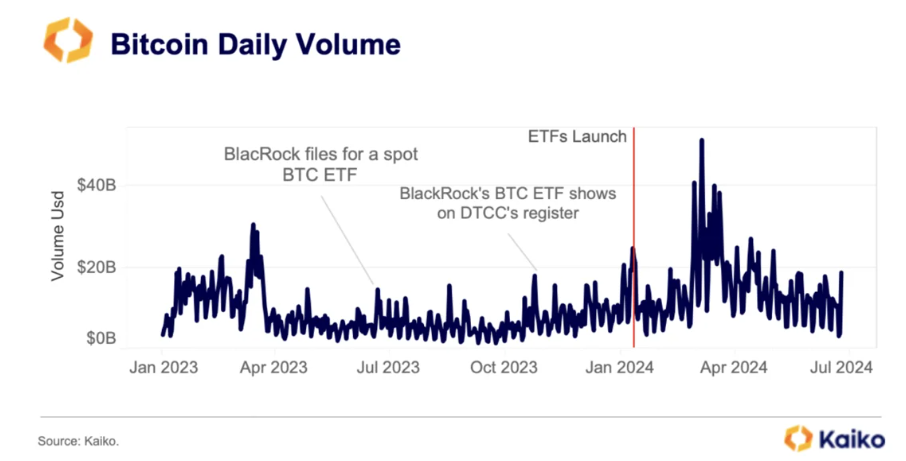

Since the green light for spot BTC ETFs, Bitcoin trading has really taken off. There was a bit of a rebound in October, after volumes had dropped to multi-year lows in the summer. This was probably because it looked like the ETFs might get the go-ahead. This surge was down to market optimism and a favourable macroeconomic environment for risk assets, with six US interest rate cuts forecast for December 2024.

Hong Kong Bitcoin ETFs Miss Their Mark

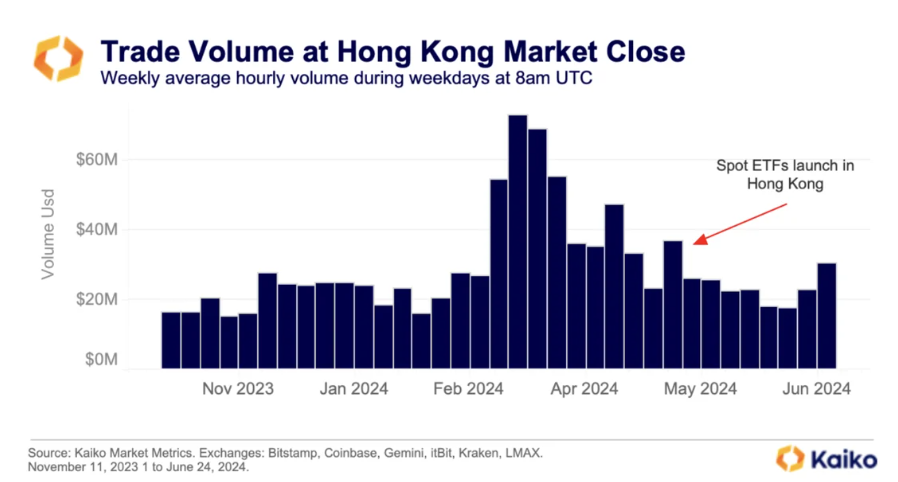

While the introduction of spot ETFs in the US has had a big impact on Bitcoin trading volumes, the recent introduction of spot ETFs for both Bitcoin and Ethereum in Hong Kong in April didn't have quite the same effect, according to Kaiko. Weekly data shows that the average Bitcoin trading volume during Hong Kong market close in the week BTC ETFs were introduced was $37 million. However, this amount was well below its peak of $73 million in March. This is probably because Hong Kong is a much smaller market than the US, and the market conditions at the time of the spot BTC and ETH ETF introductions in Hong Kong were different from those during the US introductions.

The Hong Kong funds were launched after Bitcoin's fourth halving, when the price was pretty much flat and many US spot BTC ETFs had seen their first outflows.

Kaiko also pointed out that market sentiment in April was more pessimistic than earlier in the year, as the rates at which people were funding Bitcoin turned negative. It seems that ETFs have had a bigger impact on Bitcoin spot markets on US-regulated exchanges. For instance, Binance, the world's largest exchange, which isn't regulated in the US, sees its busiest trading periods around the US market, which then tail off as the day goes on. Binance isn't included in any ETF benchmark because most Bitcoin trading volume is settled against stablecoins. ETF benchmarks only consider BTC/USD prices. On the other hand, Coinbase, the biggest exchange for all Bitcoin reference rates and a US-regulated exchange, sees a lot of trading in the open US market. These volumes average around $220 million at market close during the benchmark fixing window.