On July 6, Spot Bitcoin ETFs saw a significant surge in inflows after the U.S. Independence Day, when Bitcoin's price dropped below $54,000.

Largest Net Inflow in a Month

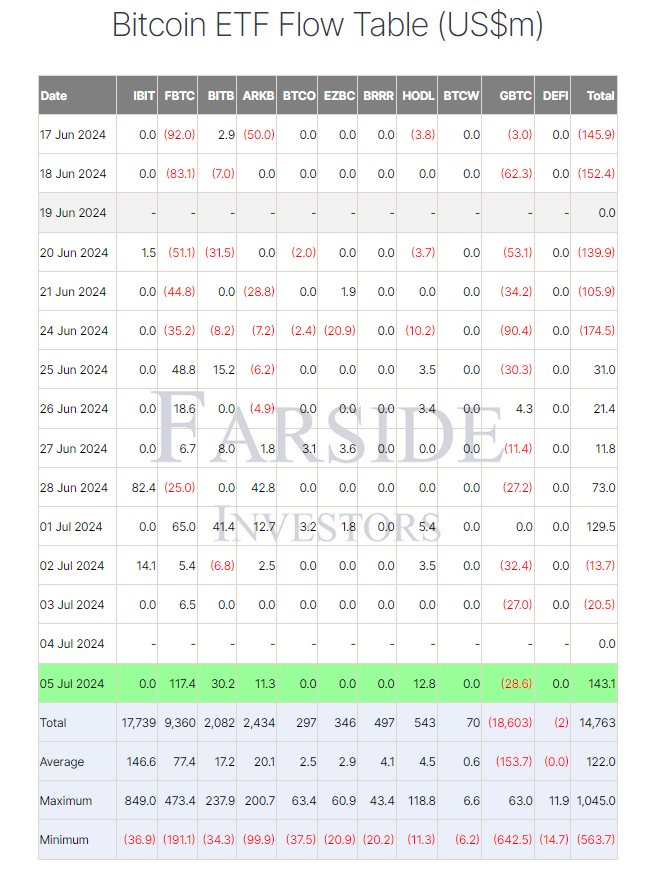

Farside monitoring reported the largest net inflow in a month for Spot Bitcoin ETFs, with an impressive $143.1 million flowing into these financial products.

Leading Inflows

The Fidelity Bitcoin ETF (FBTC) led the way with a substantial $117 million, reflecting strong investor confidence. Other notable inflows included:

In contrast, the Grayscale Bitcoin Trust (GBTC) faced a net outflow of $28.6 million, highlighting a different trend compared to other Spot Bitcoin ETFs.

Institutional Confidence

Despite recent market turbulence, these substantial inflows indicate that institutional investors and large-scale buyers are leveraging the price dip to accumulate Bitcoin at lower prices. Hunter Horsley, CEO of Bitwise Asset Management, emphasized this opportunity on social media, noting his team’s efficiency in acquiring Bitcoin at minimal cost.

Horsley stated, "The outlook for Bitcoin has never been stronger. For many who don’t yet have exposure, this week is a chance to buy the dip."

During the first week of July, BITB registered inflows exceeding $66 million, boosting its total Bitcoin holdings to over 38,000. This growth underscores continued confidence in Bitcoin's long-term potential despite short-term volatility.

Market Resilience

Bitcoin critic Peter Schiff acknowledged the resilience of Bitcoin ETF investors amidst market fluctuations. Despite recent downturns, these investors remain steadfast, showing no signs of panic. Schiff commented, "So far, there’s no sign of panic. It will likely take a much larger drop in Bitcoin before they finally capitulate."

Schiff also suggested that a significant sell-off could occur soon, potentially leading to capitulation among Bitcoin holders.

Recent Market Movements

Bitcoin fell to $55,200 on Coinbase after the collapsed Japanese crypto exchange Mt. Gox transferred 47,229 Bitcoin—worth $2.71 billion at current prices—to a new wallet address, marking its first major transaction since May.

This dynamic market environment continues to present opportunities and challenges for investors, with significant movements and trends influencing their strategies.