Tesla, the electric vehicle giant led by Elon Musk, has caused a stir in the cryptocurrency market following the recent movement of its substantial Bitcoin holdings. According to Arkham Intelligence, Tesla has retained its $777 million worth of Bitcoin after transferring its entire stash to multiple new wallets, sparking speculation of a possible sell-off. However, the 11,509 BTC, valued at over $772 million, remains in Tesla's control.

Routine Transfers or Something More?

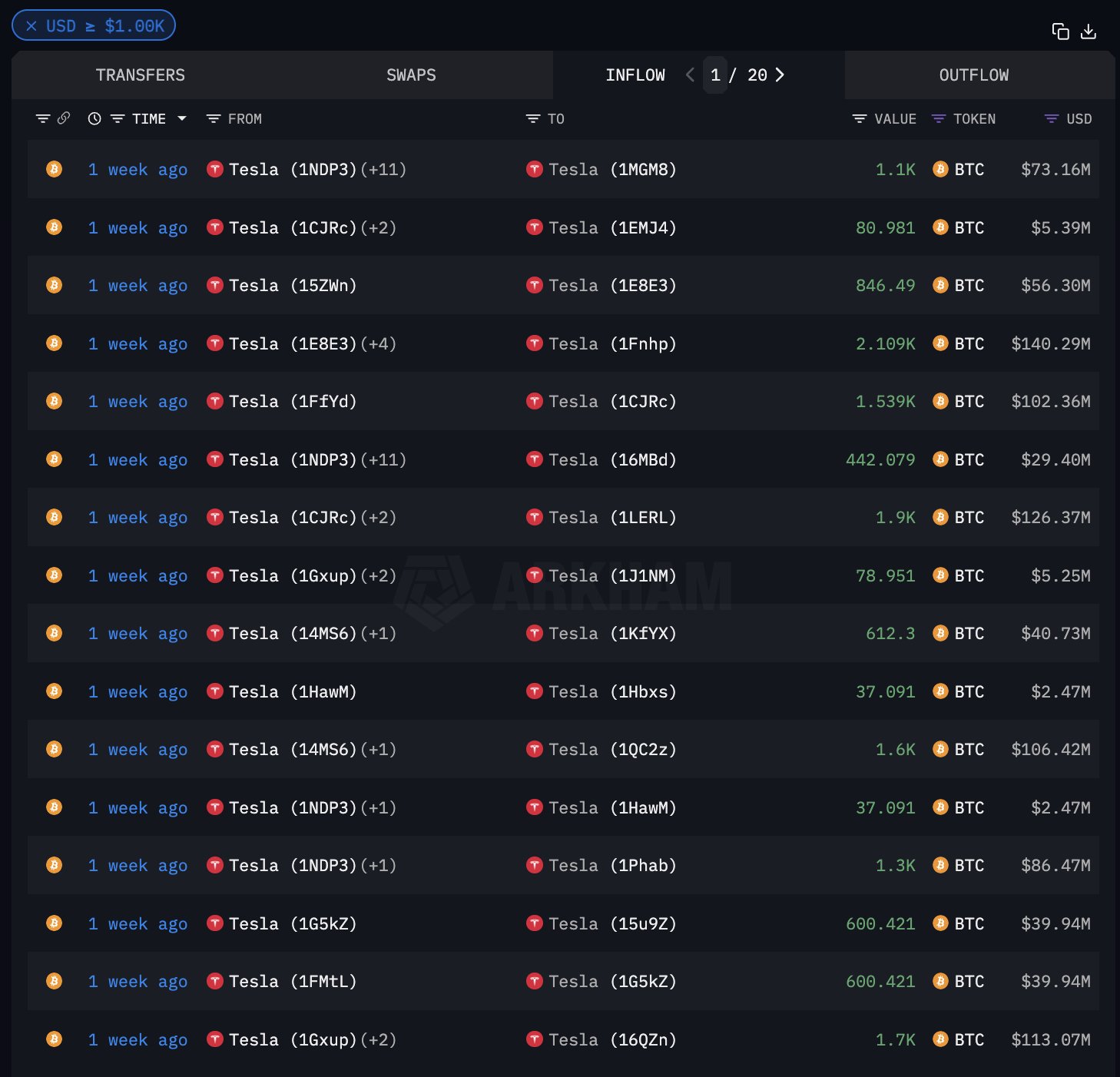

The transfer, which took place last week, spread Tesla’s Bitcoin holdings across seven wallets, with each wallet holding over 1,000 BTC. The largest balance of 2,109.3 BTC, valued at approximately $141.4 million, sits in the "1Fnhp" wallet. Despite the movement, there has been no official explanation from Tesla regarding the transfers, leaving traders and analysts guessing about the company’s intentions.

Source: https://twitter.com/ArkhamIntel/status/1848824051520946468

While some feared a potential sell-off, others speculated the funds could be earmarked as a donation to Donald Trump’s election campaign, given Musk’s support for the former president. More plausible theories suggest that the Bitcoin may have been moved to a custodian, or that Tesla could use its Bitcoin as collateral for securing a loan.

Tesla is set to release its Q3 earnings report on October 23, and many in the crypto community are eager to see if the company will reveal any insights into its Bitcoin activity and financial position.

Tesla’s Bitcoin History:

Tesla’s involvement with Bitcoin began in February 2021 when the company made headlines by purchasing $1.5 billion worth of Bitcoin. Shortly after, it sold 4,320 BTC to test market liquidity. In June 2022, Tesla sold 29,160 BTC at an average price of $20,000 per coin, a move Musk said was intended to strengthen the company’s cash reserves due to uncertainties caused by the Covid-19 pandemic and China’s lockdowns.

Despite selling a portion of its holdings, Tesla remains the fourth-largest corporate Bitcoin holder, behind Marathon Digital, Riot Platforms, and MicroStrategy, which leads with a staggering 252,220 BTC.

Could Bitcoin Payments Be Back on the Table?

Tesla was one of the first major corporations to accept Bitcoin as payment for its vehicles in March 2021. However, the company reversed this decision just a few months later, citing environmental concerns regarding Bitcoin mining. Musk promised that Tesla would resume accepting Bitcoin once the cryptocurrency achieved sustainable energy levels.

In October 2023, Bloomberg Intelligence's Coutts suggested that Bitcoin mining had crossed the renewable energy threshold, with more than 50% of its operations powered by clean energy—a key condition Musk set for reconsidering Bitcoin payments. With this shift toward sustainability, speculation is growing that Tesla may once again start accepting Bitcoin as a payment method.

However, no official announcement has been made regarding this potential move, leaving the market in anticipation.

Conclusion:

Tesla’s decision to hold onto its $777 million Bitcoin reserve, combined with the recent transfer of its holdings, has sparked renewed interest in the company's stance on cryptocurrency. As Bitcoin mining becomes more sustainable, the possibility of Tesla accepting Bitcoin payments again seems more likely. With the upcoming Q3 earnings report and growing optimism around Bitcoin’s environmental improvements, all eyes are on Tesla to see if BTC payments could make a return.