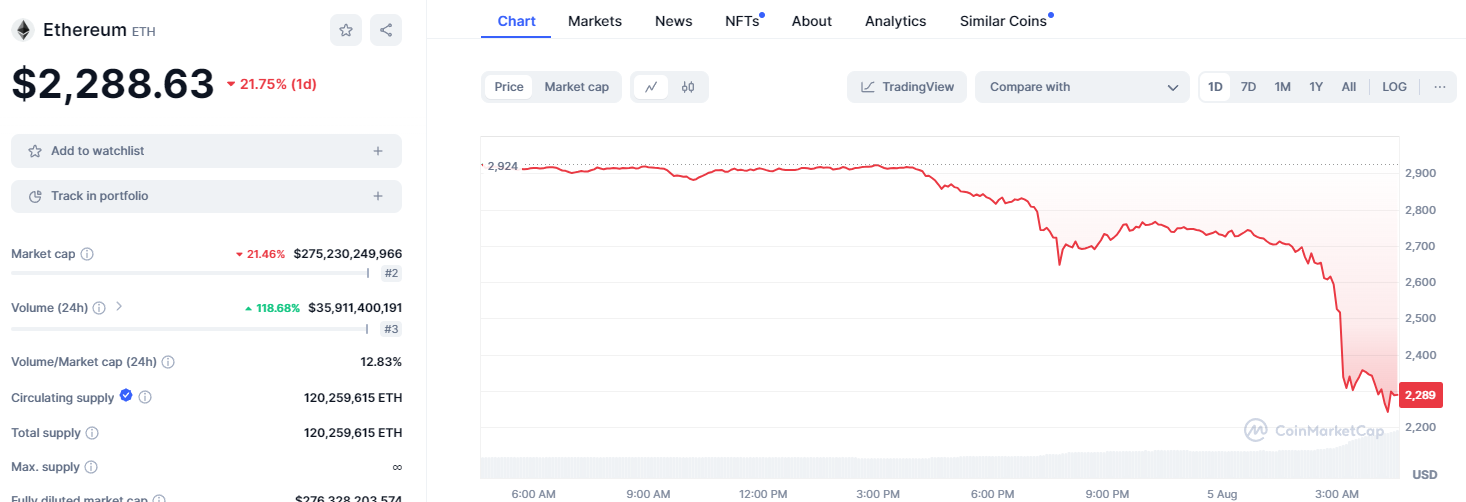

On August 5th, 2024, Ethereum experienced a significant price drop of approximately 20%. This decline can be attributed to a confluence of market events and economic factors, which have collectively exerted downward pressure on the cryptocurrency.

1. "Sell-the-News" Reaction The recent launch of eight spot Ethereum ETFs (Exchange Traded Funds) triggered a "sell-the-news" reaction among investors. This phenomenon occurs when market participants sell off assets following a highly anticipated positive event, having already priced in the expected impact. Consequently, the price of Ethereum declined sharply as traders took profits.

2. Significant Liquidations and ETF Outflows The market also saw substantial liquidations in Ethereum futures, with long positions being unwound due to adverse price movements. Additionally, there were notable outflows from Ethereum-focused investment vehicles, including Grayscale's Ethereum Trust. These withdrawals indicate a shift in investor sentiment and a preference for alternative, lower-cost options.

3. Broader Market Conditions The broader technology market has been under pressure, experiencing a sell-off that has spilled over into the cryptocurrency sector. Concerns about the global economic outlook, particularly regarding inflation and interest rate hikes by the US Federal Reserve, have dampened investor confidence. This broader market turbulence has contributed to the negative sentiment around cryptocurrencies, including Ethereum.

4. Mt. Gox Bitcoin Reimbursements The ongoing reimbursement of Mt. Gox creditors with Bitcoin has added to the market's volatility. As these reimbursements increase the supply of Bitcoin, they exert downward pressure on the price, which in turn affects Ethereum due to the high correlation between major cryptocurrencies.

The combination of these factors has led to a sharp decline in Ethereum's price, reflecting the complex interplay of market sentiment, economic conditions, and specific events within the cryptocurrency ecosystem.